/ Globe PR Wire /

Amidst the frequent volatility characterizing today’s global financial markets, a growing number of investors are re-evaluating a fundamental question: In an environment of high uncertainty, should investment decisions be grounded in emotional judgment, or anchored in verifiable systems and logic?

It is against this backdrop that Arvex AI, an intelligent quantitative investment platform, has gradually moved into the industry spotlight. Distinguishing itself from approaches focused on short-term gains or market sentiment, Arvex AI positions itself as a “practitioner of systematic investment thinking.” The platform aims to leverage technology to restore rationality and comprehensibility to the investment process.

Headquartered in New York, Arvex AI is a fintech firm specializing in artificial intelligence and quantitative research.

The platform posits that true investment capability stems not from predicting singular market movements, but from a long-term, stable, and replicable decision-making framework. Consequently, its core system has been engineered from its inception to center on data analysis, risk identification, and execution discipline.

Arvex AI utilizes artificial intelligence models to conduct continuous market modeling. It systematically analyzes price volatility, trading structures, and potential risks, automatically executing corresponding strategies within the parameters of preset rules. The entire process emphasizes logical consistency and risk boundary control, aiming to minimize the impact of human emotion on investment decisions.

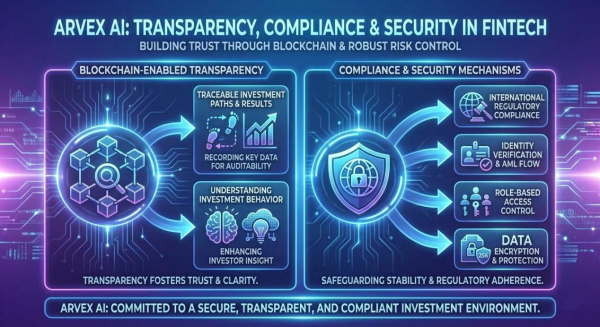

In the current landscape of rapid fintech development, transparency has emerged as a focal point for investors. Arvex AI has integrated blockchain technology into its system architecture to record specific critical data points, ensuring that investment execution paths and outcomes are fully traceable.The platform maintains that transparency not only fosters trust but also aids investors in comprehending the nature of the investment behavior itself.

Regarding compliance and security, Arvex AI states that it strictly adheres to international regulatory requirements.The platform has established robust risk control and security protection mechanisms, including identity verification, Anti-Money Laundering (AML) protocols, tiered permission management, and data encryption, to guarantee the stability and operational compliance of the platform.

Industry experts note that as investor sophistication matures, the benchmarks for evaluating intelligent investment platforms are shifting. The focus is moving away from a purely “yield-oriented” approach toward prioritizing “system reliability, risk management capabilities, and long-term sustainability.” This transition represents a new industry trend one that is mirrored in the development trajectory of Arvex AI.

Looking ahead, Arvex AI plans to further deepen its research into artificial intelligence models, expand into new markets and application scenarios, and drive the standardized development of intelligent quantitative investment on a global scale.

Media Details:

Company Name: Arvex AI

Contact Person: Anthony Paul Staples

Address: NY